Courtney LaCaria

Housing & Homelessness Research Coordinator

Mecklenburg County Community Support Services

In October, Mecklenburg County Community Support Services released the 2021 Charlotte-Mecklenburg State of Housing Instability & Homelessness (SoHIH) report. The report provides a single, dedicated compilation of all the latest local, regional, and national data on housing instability and homelessness pertaining to Charlotte-Mecklenburg.

The report is intended to be the “go-to” resource for all stakeholders working to address housing instability and homelessness in Charlotte-Mecklenburg. It is anchored by the three main components of the housing continuum: housing instability; homelessness; and permanent, affordable (or stable) housing. As the report is designed to make information easily accessible, there are also helpful complementary materials available; these will help connect the data with stakeholders. These resources include the Key Findings Handouts, Report Toolkit, and Housing Data Factsheet.

The blog post from October 14 shared three key themes from the 2021 SoHIH report and the blog post from October 21 unpacked the first them around the need for more permanent, affordable housing. This blog post will take a deeper dive into the second theme regarding how COVID-19 has exacerbated the pre-existing problems of homelessness and housing instability, disproportionately impacting minority and low-income households; and ultimately, what this means for Charlotte-Mecklenburg.

THE TRENDS, PRE-PANDEMIC

On pages 14 – 18, the 2021 SoHIH report outlines the causes of housing instability and homelessness, which center around three main areas: 1) structural and systemic racism; 2) the growing gap between what housing costs, and what households can afford; and 3) the lack of available and affordable permanent housing. Some of the factors associated with these system-level areas may be recent; however, they are fed by legacies like redlining, which have created the situation we face today.

According to the National Low Income Housing Coalition, the United States faces a shortage of nearly 7 million affordable and available rental homes for households with the lowest income. In Charlotte-Mecklenburg, the number of low-cost rental units (those which rent at or below $800 per month) has dropped from 45% of all rental units in 2011 to just 22% of units in 2019. This has contributed to the current gap of over 23,000 rental units for extremely low-income households in Charlotte-Mecklenburg.

There are other barriers, like Source of Income Discrimination (SOID), that prevent housing subsidies and vouchers from being used for the remaining units, including those that are leased at market rate. This further reduces the supply. According to the 2020 SoHIH report, 44% percent of rental applications placed by INLIVIAN Housing Choice Voucher holders between April and December 2019 were denied. In addition, 7% of those (or 53 households) who were experiencing homelessness and were surveyed on the night of the 2020 Point-in-Time Count, had some form of housing subsidy in hand but were still unable to access permanent, affordable housing.

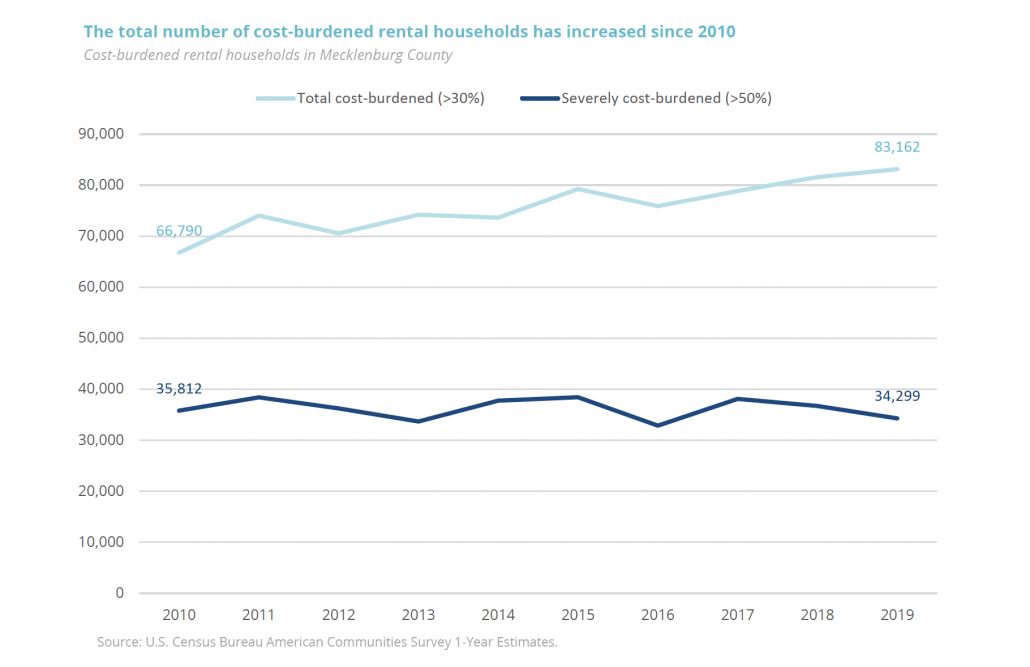

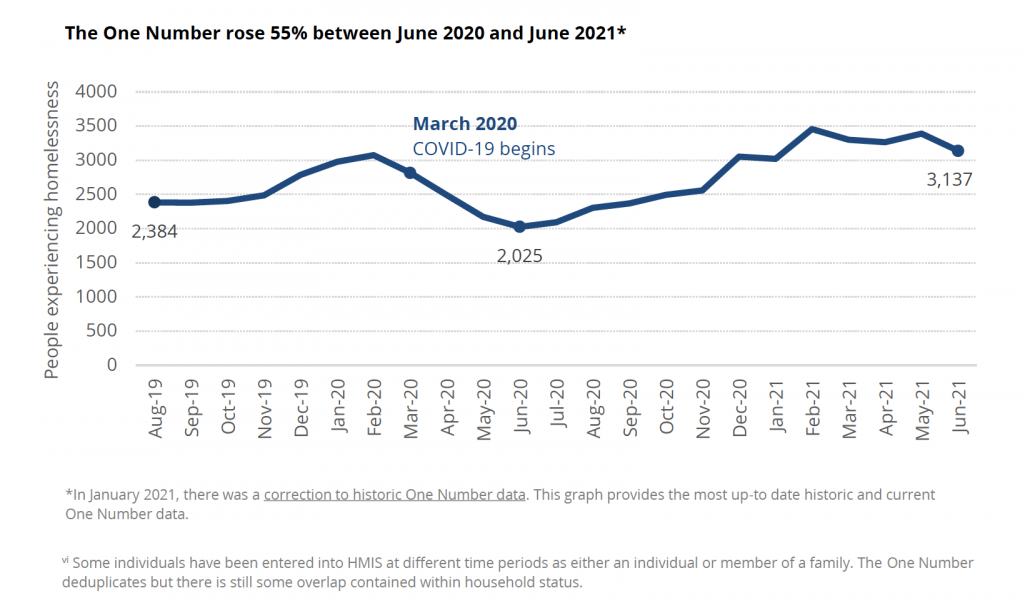

As the charts (below) from the 2021 SoHIH report indicate, the number of households experiencing renter cost-burden (at all income levels), as well as homelessness, in Charlotte-Mecklenburg were increasing even pre-COVID-19. According to national Point-in-Time Count data, these local trends mirror what is occurring at the national level, with an increase of 13,000 people from the January 2019 count to January 2020.

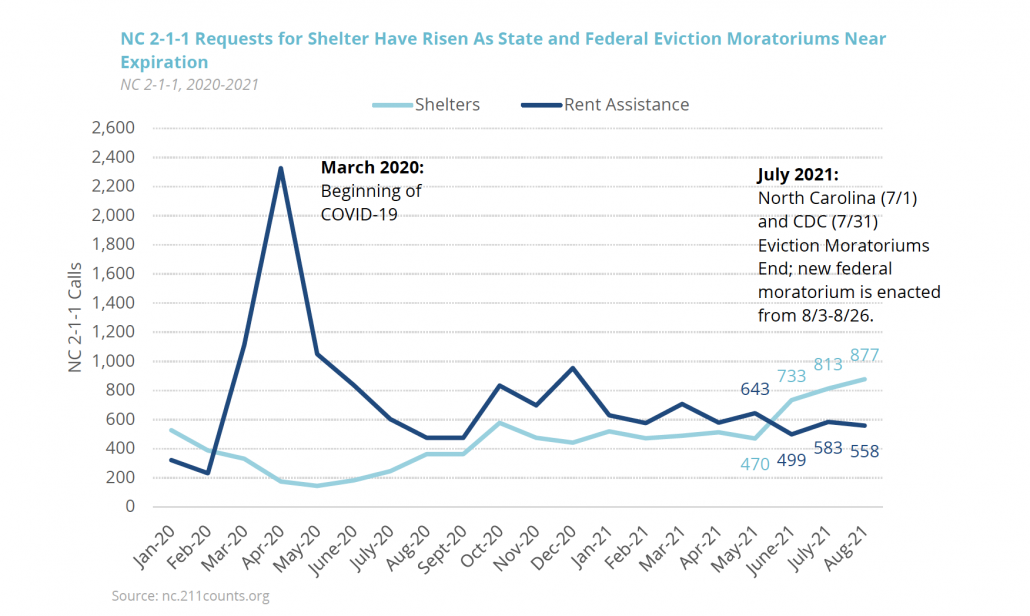

During the initial months of the pandemic, the number of households seeking rental assistance via NC 2-1-1 increased 900%. These requests decreased with the implementation of state and federal eviction moratoria. These calls have started to rise again as the moratoria have expired.

This means both that Charlotte-Mecklenburg started in a deficit, and that there are not enough new, permanent affordable housing units being added to the inventory to keep pace with the need for them. The local Housing Trust Fund has supported the development, preservation, or rehabilitation of 11,596 total units between FY2002 and FY2021. After deducting the total number of units that were emergency shelter beds for people experiencing homelessness (888); and the total number of units that are pending and/or under construction (2,815); this equates to a total of 7,893 total new units over nineteen years, or 415 new units on average per year.

WORSENING TRENDS, DISPROPORTIONATE IMPACT

COVID-19 has underscored the extent to which housing instability and homelessness have resulted in disproportionate impacts among low-income and minority households, widening gaps and worsening disparities.

Consider the following key findings from the 2021 SoHIH report:

- As of July 2021, 22% of low-income renters (those who have a household income of less than $35,000 annually) were behind on rent, compared with 16% of total renters. Renters of color were also more likely to be behind on rent: between August 2020 and July 2021, 26% of Black or African American renters; 20% of Hispanic or Latinx renters, and 19% of Asian renters were behind on rent, compared with 11% of White renters (page 22).

- Unemployment during the pandemic was highest among racial and ethnic minority groups and employees in low-wage jobs; and persons of color were more likely to experience unemployment than White persons (page 27).

- Twenty-two percent of Black households experienced food insecurity in 2020 compared to 12% of White households.

These local trends also track with those occurring nationally. According to the 2021 State of the Nation’s Housing Report, 25% of households earning less than $25,000 were behind on their housing payments at the start of 2021, compared to six percent of households earning more than $75,000. In addition, among renter households with the least income, more than one third of Black renters and one quarter of Hispanic and Asian renters were behind on rent in early 2021, compared to 17 percent of White renters.

Fundamentally, households with extremely low incomes cannot make the math work: a four-person family at 30% of Area Median Income (AMI) can afford $663 a month in rent, but the the fair market rent for a 2-bedroom apartment is $1,151. A single individual at this income level can afford $442 in rent, but a 1-bedroom unit rents for $1,010 per month. This household income-to-housing cost gap equates to housing instability. And the gap is vast, both in terms of households in need and the amount of need by household. It is also disproportionately comprised of households of color. According to the latest data from the National Low Income Housing Coalition, “people of color are much more likely than white people to have extremely low incomes. Twenty percent of Black households, 18% of American Indian or Alaska Native households, 14% of Latino households, and 10% of Asian households are extremely low-income renters. Only 6% percent of white non-Latino households are extremely low-income renters.”

In Charlotte-Mecklenburg, there are 83,162 renter households and 44,546 owner-occupied households who are cost-burdened, which means that they are paying more than 30% of their income to housing related expenses. These households are at an especially high risk of being evicted. Even if a household does not get physically evicted from their home, there are immediate and longer-term consequences resulting simply from an eviction filing.

At the other end of the housing continuum, a lack of permanent, affordable housing leads to increases in homelessness; longer stays in emergency shelter; and the need for greater resources to help households regain housing. The total number of people experiencing homelessness as of August 31, 2021, was 3,149. This includes 341 families, 2,047 single individuals, and 126 unaccompanied youth. Like housing instability, homelessness disproportionately impacts households of color. Of the 3,149 individuals actively experiencing homelessness in Charlotte-Mecklenburg, 76% identified as Black/African American, compared to 14% of individuals identifying as White. Moreover, the rate of homelessness among Black/African Americans is much higher than their proportion of the Mecklenburg County population (76% versus 33%) while individuals who identify as White, non-Hispanic experience homelessness at a rate much lower than their prevalence in the population (14% versus 47%).

SO, WHAT

While COVID-19 has worsened housing instability and homelessness, the virus did not cause these problems. Housing instability and homelessness are pre-existing conditions; and, worse, the households who are at the greatest risk of loss of housing are also those who are also highly susceptible to, and at elevated risk of complications from, COVID-19. As of July 2021, more than 28,000 households in Mecklenburg County were estimated to be behind on rent, owing an average of $3,589.

Weathering the storm of the pandemic has been especially difficult for households with the lowest incomes and the fewest assets. To cover the gap owed for expenses during the pandemic, especially prior to the advent of rental relief assistance, many households who were already facing housing instability borrowed from sources which only burdened them further, including high-interest loans or maxing out their credit cards.

According to the 2021 State of the Nation’s Housing Report, “the ability to withstand a temporary loss of income depends largely on having a reserve of wealth and homeowners have a huge advantage over renters. At last measure in 2019, the median wealth for homeowners was $254,900—more than 40 times the $6,270 median for renters. Even excluding home equity, the median wealth of owners was $98,500, or more than 15 times that of renters. Wealth also differed widely by race and ethnicity, as the median wealth of white households was more than seven times that of Black households and over five times that of Hispanic households.”

The extent to which households were better financially prepared to make ends meet during the pandemic is rooted in the systemic and structural causes which pre-dated COVID. And the extent to which these households will ever be able to catch up is likewise tied to addressing those underlying, pre-existing conditions. Coupling these historic disparities with the lingering impacts of the pandemic, the 2021 SoHIH report concludes that, “without widespread investment and intervention, the number of households facing housing instability and homelessness will likely increase in the months and years ahead.”

Fortunately, the federal government has allocated substantial relief funding to communities, including the potential addition of $150 billion in housing investments, including for public housing repairs; voucher expansion; increases in the National Housing Trust Fund; and first-generation homebuyer down-payment assistance. To the extent that federal legislation is passed with the goal of addressing housing instability and homelessness, and to the extent that state and local coffers are not negatively impacted by COVID, there may be greater resources available to tackle these issues than at any time in recent history. Indications locally are that there is also a great deal of interest, in all sectors, in addressing housing instability and homelessness; one measure is the number of individuals and organizations who have engaged in the work connected to the Charlotte-Mecklenburg Housing & Homelessness Strategy. If the community has sufficient will to act, this one-in-a-lifetime confluence of factors can result in a once-in-a-lifetime opportunity for a great many of the people whose lives actually depend on it.

Stay tuned for future blog posts, which will take a deeper dive into the other key findings from the 2021 SoHIH report.

There will be no Building Bridges blog post next week, as Mecklenburg County is closed in observance of Veteran’s Day. In addition to services that support households experiencing homelessness, domestic violence and substance use, Mecklenburg County Community Support Services also provides services to veterans. To learn more about the Veteran Services Division, please click here.

SIGN UP FOR BUILDING BRIDGES BLOG

Courtney LaCaria coordinates posts on the Building Bridges Blog. Courtney is the Housing & Homelessness Research Coordinator for Mecklenburg County Community Support Services. Courtney’s job is to connect data on housing instability, homelessness and affordable housing with stakeholders in the community so that they can use it to drive policy-making, funding allocation and programmatic change.