Courtney LaCaria

Housing & Homelessness Research Coordinator

Mecklenburg County Community Support Services

Released last month, A Home for All: Charlotte-Mecklenburg’s Strategy to End and Prevent Homelessness – Part 1: Strategic Framework reflects the community’s work during the past year to develop a comprehensive, transformative strategy to address both housing instability and homelessness. As the first document to be released from this effort, the Strategic Framework provides the roadmap for the work ahead. The framework serves to outline the vision and the major objectives across each of the following nine areas: prevention; shelter; affordable housing; cross-sector supports; policy; funding; data; communications; and long-term strategy.

While any one area of impact and intervention can help chip away at the gaps, the real work must be done on the sum rather than the parts. At the same time, it is essential that we understand each individual part so that we can best position them to complement each other and function effectively as a system. This week’s blog is the third in a new series that seeks to unpack each of the four impact areas in the Strategic Framework aimed at addressing a part of the housing continuum: prevention; temporary housing; affordable housing; and cross-sector supports.

This blog is focused on affordable housing, covering what it is, why it is important, what the recommendations in the Strategic Framework entail, and ultimately, what all of this could mean for Charlotte-Mecklenburg.

WHAT IS AFFORDABLE HOUSING?

Housing, regardless of typology, is generally considered “affordable” if a household does not have to spend more than 30% of their pre-tax, gross annual income on their housing-related expenses. Households who pay more than 30% of their gross income on housing-related expenses are identified as being “housing cost-burdened.” If a household has to pay more than 50% of their gross income on housing-related expenses, then they are “severely cost-burdened.” “Housing-related expenses” include not only the cost of the rent (or mortgage), but utilities and other expenses directly related to sustaining housing.

Affordable housing is generally applied to households ranging in income from 0% to 120% of Area Median Income (AMI). Using FY2021 data for a family of four, this annual income range spans from $0 all the way to $101,040. The latest (FY2022) Fair Market Rent for a 2-bedroom apartment in Mecklenburg County is $1,155. A four-person household at 30% of AMI can afford (at most) $663 per month in rent and utilities without being cost-burdened. In contrast, the same size household at 80% of AMI can afford $1,684 per month in rent and utilities. Therefore, when new “affordable housing” is developed or existing “affordable housing” is preserved, it is important to understand (and ask) for all of the details, such as how many units will be made available and at what AMI levels.

Permanent, affordable housing more typically is used to refer to the physical units, themselves. Permanent, affordable housing can also mean the financial assistance used to gap the difference between what housing costs and what households can afford. Examples of financial assistance include short-term rental subsidies, such as rapid re-housing, the new, Emergency Rental Assistance Program (funded through COVID-19 relief aid and known locally as RAMPCharMeck) as well as long-term subsidies and/or vouchers like permanent supportive housing and Housing Choice Vouchers. It also includes support to purchase a home such as down-payment assistance. Financial assistance for both renters and homeowners is funded by public and private entities at the local, state, and federal levels.

There are three primary considerations related to permanent, affordable housing: preserving existing units and resources; adding new units and resources; and removing barriers to available units and resources. Preserving existing housing stock includes the retention of Naturally Occurring Affordable Housing (NOAH) and other lower-cost rental inventories as well as the rental subsidies needed to gap the difference in cost and affordability.

A subsidy may not be necessary if the rental unit is already affordable; this is typical of NOAH units. In other instances, a short-term rental subsidy, combined with access to a rental unit at or near market rate, may be necessary until a household stabilizes and can afford the unit independently; or as we have seen during the pandemic, to keep households safely in their housing by providing emergency rental assistance. It is important to consider both the need for financial assistance and the physical units to meet the need when considering solutions.

WHY INCLUDE AFFORDABLE HOUSING?

Using this definition for affordable housing, it should be apparent that everyone desires to live in housing that is “affordable” to them. However, the way the term “affordable” is widely applied serves only to artificially stratify the housing market, instead of recognizing the universality of the desire for any household to be unburdened by their costs of housing. Even though “affordable housing” has become another proxy for perpetuating segregation and inequity, the reality is that everyone wants housing that is “affordable.”

Prior to the pandemic, there was a growing deficit of permanent, affordable housing in Charlotte-Mecklenburg. This deficit was already especially large for households with income at or below 30% of AMI. For a family of four, this means an annual income that is at or under $26,500. For a single individual, the number is $17,700. For comparison, the annual income for a full-time, single individual earning minimum wage ($7.75 per hour) is $16,120, which falls at approximately 19% of Area Median Income. In Mecklenburg County, there is a current need for more than 23,000 permanent, affordable units just to serve households with income below 30% AMI.

Now, in the pandemic era, the need for permanent, affordable housing (as well as the debt accumulating from households struggling to maintain the housing they already have) is growing. According to the 2021 State of Housing Instability and Homelessness Report (SoHIH), more than 28,000 households in Mecklenburg County have high rental debt; the average estimated amount is $3,589 per household. At bottom, the solution to housing instability and homelessness is housing.

WHAT ARE THE RECOMMENDATIONS?

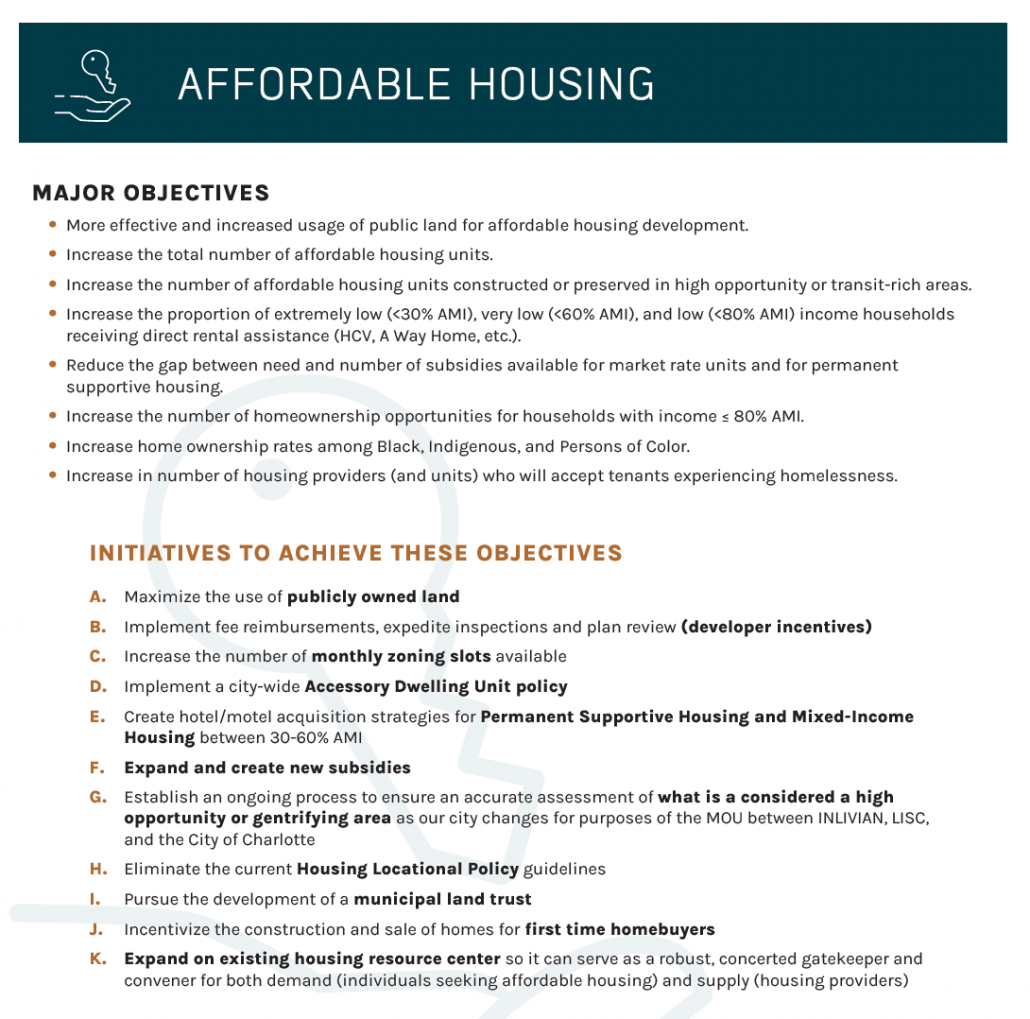

Listed below are the 11 temporary housing recommendations from the Strategic Framework, in priority order. Each of these recommendations have been informed by best practices and research. Included with the name of the recommendation is a description of what the recommendation means and, where relevant, additional context to help illustrate the “why” behind the recommendation.

A. Maximize the use of publicly owned land

The goal of this recommendation is to mitigate two major barriers to the expansion of affordable housing: the high cost of land and sheer lack of available, affordable units, especially for households with the lowest income. This recommendation focuses on publicly owned land, including land which is located near current and/or future transit lines; land declared excess by the Charlotte-Mecklenburg Board of Education (GS 160 A – 274), City of Charlotte and/or Mecklenburg County; and land around the Charlotte Douglas International Airport where appropriate.

B. Implement fee reimbursements, expedite inspections and plan review (developer incentives)

This recommendation, which applies to Mecklenburg County and the City of Charlotte, seeks to, through multiple and/or layered incentives, expedite the development, preservation and/or rehabilitation of affordable housing units for households with income at or below 80% AMI as well as preserving affordability for a minimum of 15 years. In addition, this recommendation requires that developments must include some portion of units for households with income at or below 30% AMI.

C. Increase the number of monthly zoning slots available

As a method by which to expedite the number of affordable housing units that are developed, preserved and/or rehabilitated, this recommendation seeks to increase, by 50%, the number of monthly zoning slots for developments that include at least 10% of housing units for households with income at or below 80% AMI and which preserve affordability for at least 15 years. In addition, this recommendation proposes dedicating staff resources to review and expedite the approval of zoning applications for affordable housing units.

D. Implement a city-wide Accessory Dwelling Unit policy

This recommendation entails providing financial incentives to property owners within the City of Charlotte who are willing to rent an Accessory Dwelling Unit (or ADU) located on their property to a household with income at or below 60% of Area Median Income. According to the City of Charlotte, an “accessory dwelling unit” is defined as “a second dwelling unit created on a lot with a single family detached dwelling unit and may either be located within the principal detached dwelling or within a separate accessory structure.” In addition, similar policies and/or incentives could be replicated within the zoning ordinances of the other townships within Mecklenburg County.

E. Create hotel/motel acquisition strategies for Permanent Supportive Housing and Mixed-Income Housing between 30-60% AMI

This recommendation embraces the practice of “adaptive reuse” which has gained steam during the pandemic. In fact, Affordable Housing Finance reports that more than 20,100 units across offices, hotels and other buildings were tapped to be transformed into apartments in 2021, which is double the number of apartment conversions from the two previous years. Specifically, this recommendation seeks to maximize un- and/or underutilized hotels and/or motels, converting them to either permanent supportive housing (which targets household experiencing chronic homelessness) or mixed-income housing, which supports households with varying AMI levels. In addition, like many other communities and states who are doing the same, this recommendation leverages the use of COVID-19 relief funding that specifically targets the conversion of hotels and/or motels for affordable housing.

F. Expand and create new subsidies

This recommendation focuses on the use of rental subsidies to help gap the cost between what housing costs and what households can afford. Rental subsidies can be funded by both the public and private sectors; can range from short-term to long-term; and can incorporate cost for other housing-related expenses like utilities. This recommendation would prioritize the use of subsidies for households with income at or below 50% AMI; target the use of subsidies in “high opportunity” areas; and provide incentives to encourage landlord participation. According to a 2018 brief by Freddie Mac, while there is not a universal definition for high opportunity, “these neighborhoods often provide access to certain amenities or community attributes that are believed to increase economic mobility for their residents. However, they are also often encumbered by high costs of living and dense populations. As a result, the supply of affordable housing is unable to support the demand. In an effort to combat this, there has been an increased focus from research, policy and affordable housing groups on deconcentrating poverty and promoting affordable housing in high opportunity areas.”

G. Establish an ongoing process to ensure an accurate assessment of what is a considered a “high opportunity” or gentrifying area as our city changes for purposes of the MOU between INLIVIAN, LISC, and the City of Charlotte

This recommendation is tied to the potential use of project-based housing vouchers in newly developed affordable housing projects, which will help leverage investments from other public and private sources, including the Housing Trust Fund and the Charlotte Housing Opportunity Investment Fund. In addition, this strategy embodies the first core value of the Strategic Framework, by attempting to change the practices that lead to economic and racial segregation of housing. Strategies include amending the geographies to include additional high opportunity census tracts and rapidly gentrifying areas.

H. Eliminate the current Housing Locational Policy guidelines

Last updated in 2019, the City of Charlotte’s “Housing Locational Policy” is used to inform the “selection of housing investments that create or preserve affordable rental housing and workforce rental housing in areas near employment centers, commercial, recreational, and social centers; existing and proposed transit services; Center City; and in neighborhoods experiencing rapid demographic change.” This recommendation seeks to remove these guidelines altogether, which would provide the greatest amount of flexibility for creating new affordable housing units; reduce and/or eliminate the stigma of affordable housing; enable the development of affordable housing in areas experiencing neighborhood change; and allow investment decisions to be based on the merits of each individual development proposal.

I. Pursue the development of a municipal land trust

This recommendation seeks to develop a municipal land trust, which is similar to the concept of a community land trust, but is operated by the local government. Strategies include identifying and purchasing land that could be used to develop affordable housing; proactively rezoning purchased properties, if necessary, for the appropriate use and/or density; and restricting use for affordable housing purposes on a long-term basis. According to research on this issue, the benefits of a municipal land trust including reducing the number of foreclosures; enabling communities to benefit from increased land values rather than corporations and/or banks who might profit from from buying and selling the land; and protecting households from displacement by providing the opportunity for low-income households to purchase homes and by providing an equal rent credit from increasing land rent.

J. Incentivize the construction and sale of homes for first-time homebuyers

With a focus on racial equity, this recommendation seeks to support increased opportunities for homeownership, thereby creating a path for all households who desire it to be able to obtain assets and develop wealth. Strategies include increasing available sources of down payment assistance; encouraging employers to provide down payment assistance as an incentive for their workforce; expanding the number of lenders who are willing to accept homeownership vouchers from providers including INLIVIAN; increasing the amount of Housing Trust Fund subsidy available to potential homebuyers; expanding support for teachers and first responders, similar to the City of Charlotte’s Community Heroes program; doubling the House Charlotte funding per homebuyer to accommodate rising home costs; and increasing the subsidy available for local organizations to be able to acquire and rehabilitate housing for future homebuyers.

K. Expand on existing housing resource center so it can serve as a robust, concerted gatekeeper and convener for both demand (individuals seeking affordable housing) and supply (housing providers)

This recommendation seeks to create a database of affordable housing units that could be accessed as a one-stop-shop by individuals, case managers, and providers as well as landlords. The database would be able to track all properties/landlords that have agreed to accept housing referrals from programs as well as progress on pre-housing steps including applications and inspections. Finally, the entity that manages the database would provide assistance to both individuals and landlords in order to help foster and strengthen a network that supports everyone involved and also increases the supply of units.

SO, WHAT

In response to the desperate need for more permanent, affordable housing that has only worsened during the pandemic, the federal government has issued billions of dollars in relief assistance. The City of Charlotte received over $141 million and Mecklenburg County received $215 million in American Rescue Plan Act (ARPA) funding. Combined, this totals more than $356 million.

Additional federal housing investments are being considered through pieces of the Build Back Better reconciliation package. At the state level, the North Carolina Housing Finance Agency launched the North Carolina Homeowner’s Assistance Fund in February to support homeowners impacted by the pandemic. Households can receive up to $40,000 for housing-related payments.

Through a concerted public-private effort, a $950 million affordable housing bond, known as Measure A, was passed in 2016 in Santa Clara County, California. The goal of the bond is to develop 4,800 new affordable housing units with $700 million dedicated to units just for households with the lowest income. Since 2016, 830 units have been developed; 658 are due to open in 2022; and the remaining 2,953 are reported to be in progress. In addition to the public sector funding for affordable housing, Destination: Home, a public-private partnership committed to preventing and ending homelessness in the Silicon Valley, created the private sector-funded Supportive Housing & Innovation Fund. This funding is focused on developing more permanent supportive housing units and affordable housing units for households with income at or below 30% of AMI. To date, this funding has been used to develop 25 permanent supportive housing units; 2,329 units for households with income at or below 30% of AMI; capacity building for seven non-profit affordable housing developers to advance construction of 1,600 new permanent supportive housing and/or extremely low-income housing units; and and a three-year grant to fund a dedicated city-planner position that could expedite applications, thereby shortening the length of time it takes to produce new affordable housing units.

The state of Colorado is considering the largest state spending package on housing, which seeks to maximize $400 million in ARPA funding. The proposed spending plan, released by a public-private taskforce, expands upon other recently added sources of income, including the state’s “Affordable Housing Act of 2019” which created a housing development grant fund supported by an increase in the state sales tax revenue. It is estimated that the $400 million could support the development and/or preservation of 15,000 affordable units. In addition, the plan includes pro-density and pro-growth policies. Of the total dollars to be allocated, $150 million of the funding would, in effect, become a permanent source of funding: loans that repaid for the projects that support affordable housing development are then loaned for additional projects.

Funding is absolutely necessary to close the gap in the number of permanent, affordable housing units needed. The gap is large; there must be a commensurate response to address the gap. The price tag for that response will likely be hefty. But, communities have a real opportunity to be strategic with how they apply (and invest) the new ARPA relief aid in solutions that are comprehensive, effective and sustainable so that there really can be a home for all.

SIGN UP FOR BUILDING BRIDGES BLOG

Courtney LaCaria coordinates posts on the Building Bridges Blog. Courtney is the Housing & Homelessness Research Coordinator for Mecklenburg County Community Support Services. Courtney’s job is to connect data on housing instability, homelessness and affordable housing with stakeholders in the community so that they can use it to drive policy-making, funding allocation and programmatic change.